Corporate Governance

Structure of the Investment Corporation

Japan Logistics Fund, Inc. (JLF) shall have at least one executive director and at least two supervisory directors. Additionally, there shall be at least one more supervisory director than there are executive directors.

The institutions of JLF comprise: a general meeting of JLF unitholders; one executive director; three supervisory directors; a board of directors meeting comprising JLF’s executive and supervisory directors; and an accounting auditor. Please click here (link to an overview of the investment corporation) for its present composition.

Description of the Institutions

1. General Unitholders’ Meeting

Specific matters related to JLF as set forth in the Act on Investment Trusts and Investment Corporations (AITIC) or in JLF’s Articles of Incorporation (Articles) are to be decided at a general unitholders' meeting made up of JLF unitholders. Unless otherwise stipulated by law or the Articles, decisions at the general unitholders' meeting are to be made based on a majority of votes by unitholders in attendance. Changes to the Articles or other decisions set forth under AITIC Article 93(2)2 (Special Decisions) require a quorum. To form that quorum, unitholders owning a majority of units outstanding must be in attendance. Additionally, Special Decisions require at least two-thirds of the votes from that quorum. General unitholders' meetings take place once every two years in principle.

2. Executive and Supervisory Directors and the Board of Directors

In addition to executing the business of JLF, an executive director has the authority to take any judicial or extra-judicial acts related to the business of JLF on behalf of JLF.

A supervisory director has the authority to supervise the conduct of business by the executive director(s).

The board of directors (Board) has the authority to approve the convocation of a general unitholders' meeting and the execution of other specific responsibilities set forth in the AITIC. The Board also has the authorities set forth in the AITIC and the Articles, as well as the authority to supervise the conduct of business by the executive director(s). Unless otherwise stipulated by law or the Articles, decisions at a Board meeting require that a majority of persons qualified to vote are in attendance and that a majority of those in attendance vote in favor.

Officer selection criteria

REIT officers (as of July 31, 2025)

| Title | Name | Reasons for selection | Attendance at Board of Directors meetings for the fiscal period ended July 31, 2025 |

|---|---|---|---|

| Executive officer | Seiichi Suzuki | Expected to manage based on a broad perspective, including knowledge and experience in asset management | 7 times/ 7 times (100%) |

| Supervisory officer | Tsuyoshi Oyama | Expected to supervise management based on a broad perspective, including knowledge and experience as an expert in Risk Management. | 7 times/ 7 times (100%) |

| Supervisory officer | Motomi Oi | Expected to supervise management based on a broad perspective, including knowledge and experience as an expert in tax and accounting. | 7 times/ 7 times (100%) |

| Supervisory officer | Kanae Kamoshita | Expected to supervise management based on a broad perspective, including knowledge and experience as a legal expert. | 7 times/ 7 times (100%) |

Internal Control Structure

Organization, Personnel and Procedures as They Relate to Internal Controls and Supervision by Supervisory Directors

The executive director(s) holds a Board meeting once a month in principle and reports on matters for approval as set forth by law. The executive director(s) also reports detailed information on the operations of JLF and the status of business operations at JLF’s asset manager, Mitsui & Co., Logistics Partners Ltd. (MLP). Based on this reporting process, the supervisory directors, who are in a position of independence from MLP or interested parties, acquire accurate information and maintain a regime capable of supervising the status of business operations by the executive director(s).

Under the asset management agreement, JLF has the right to receive a variety of reports from MLP. Through the exercise of said right, JLF maintains a regime capable of supervising the status of business operations at MLP. Furthermore, JLF has set forth insider trading control rules and strives to prevent insider trading by directors.

Internal Controls, Supervision by the Supervisory Directors and Collaboration with the Auditor

To secure effective auditing through the implementation of organizational and efficient supervision with limited personnel resources, the supervisory directors perform supervision from a position of expertise backed by their own experience and knowledge.

In addition to auditing the financial statements and the like of JLF, if the Auditor finds the conduct of business by the executive director(s) to be improper or discovers any material violation of law or the Articles, the Auditor shall report to a supervisory director and take other actions set forth by law. In doing so, the Auditor attempts to work together with the supervisory directors.

Status of a Management Regime vis-à-vis Entities Related to JLF

The executive director of JLF simultaneously holds the concurrent position of President&CEO of MLP. In that capacity, the executive director receives reports on a daily basis on the status of business operations from the administrative agent and other entities and reports the status of business operations at these various related entities to the supervisory directors at Board meetings. Additionally, the executive director learns about the status of internal controls and governance at the related entities as necessary to put in place a regime for managing the status of business operations.

Compliance and Risk management

Compliance Initiatives

Management system and programs for Overall Compliance (legal compliance, anti-corruption and respect for labor and human rights)

At the asset management company, decisions about and validation of a variety of compliance issues are conducted with the Board of Directors at the top and with the Compliance Officer and the Internal Controls Committee acting within the scope of their respective authorities and responsibilities.

The asset management company takes the following preemptive actions to avoid problems before they arise.

| ・ | Develop a compliance manual as a specific reference tool for the purpose of achieving compliance with laws, regulations and the like |

|---|---|

| ・ | Organize internal rules aimed at managing primary risks related to compliance, such as preventing conflict-of-interest transactions and shutting out any relationships with anti-social forces. |

| ・ | Implement annual reviews of risk management, evaluation and countermeasures. |

| ・ | Implement annual internal audits on all operations, including compliance, anti-corruption and ethical standards. |

| ・ | Introduce a Whistleblowers protection system. |

| ・ | Instill thorough knowledge of compliance among all officers and employees through regularly conducted training and the like. |

- All officers and employees (Both full-time and part-time employees alike)

at the asset management company are subject to compliance training.

Compliance Promotion Regime

The asset manager (MLP) achieves compliance through the following structure.

| Governance bodies | Primary roles |

|---|---|

| Board of Directors | The Board of Directors supervises and oversees the maintenance of a regime for complying with laws, regulations and the like, based on the recognition that thoroughly complying with laws, regulations and the like at MLP and JLF is of the utmost importance for management. |

| Internal Controls Committee | An Internal Controls Committee has been established as an advisory body to the Board of Directors. Its purpose is to, in principle, meet monthly and as needed if called by the Compliance Officer, to deliberate important matters related to compliance with laws, regulations and the like and provide its opinion to the Board of Directors. |

| Compliance Officer | A Compliance Officer has been established as an entity with the purpose of checking compliance with laws, regulations and the like in the overall conduct of business as well as the preparation, amendment and removal of internal rules and regulations and compliance with those rules and regulations. |

Risk Management Regime

MLP has established Risk Management Regulations, and the Board of Directors oversees the development of risk management policies and the organization of an appropriate risk management regime. With MLP Compliance Officer providing oversight and each department's general manager responsible for risk management within their respective organizations, risks associated with all operations (such as operational, financial, clerical, systems, ESG and Investment risks) are identified and monitored once a year to the extent appropriate for the substance of each risk.

Moreover, Compliance Officer and the head of the internal audit organization report on the status of risk management annually to the Board of Directors of the asset management company, checks what measures need to be taken and reviews the effectiveness of risk management processes. MLP has in place a system of oversight of risk management by the Board of Directors.

Rules Against Conflicts of Interest

MLP sets forth the following rules for transactions, including the acquisition of operating assets, that MLP causes JLF to enter into with an interested party of MLP.

1. Basic Principles

MLP must not cause JLF to enter into transactions to benefit the interests of interested parties at the expense of the interests of JLF.

2. The Scope of Interested Parties

| Interested party | Examples* |

|---|---|

| 1. Interested parties as stipulated by AITIC Article 201(1) | |

| 2. Shareholders with a stake of 5% or more of MLP’s outstanding shares | |

| 3. Corporations owning more than 50% of voting rights in any parties applicable to 2 above. | |

| 4. Corporations in which any parties applicable to 2 or 3 above own more than 50% of voting rights, either directly or indirectly. | |

| 5. Special purpose companies in which any parties applicable to 1 or 2 above own more than a 50% equity stake, silent partnership stake or preferred stake. | |

| 6. Corporations that have entered into asset management agreement with any parties applicable to 1 or 2 above. |

- Represents only some examples and is by no means comprehensive.

3. Transactions Subject to the Rules

| Transaction | Transaction terms and conditions |

|---|---|

| 1. Acquisition of operating assets (real estate, real estate beneficial interests in trust and other assets) | Real estate and the like shall be acquired at an amount that is equal to or lower than the appraisal value (for development properties, the amount shown in a pricing survey) per a real estate appraiser that is independent from MLP. |

| 2. Sale of operating assets (real estate, real estate beneficial interests in trust and other assets) | Real estate and the like shall be sold at an amount that is equal to or higher than the appraisal value (for development properties, the amount shown in a pricing survey) per a real estate appraiser that is independent from MLP. |

| 3. Lease of operating assets | Lease shall be made at appropriate leasing terms taking into consideration market rent and the like based on market data and the like prepared by a third party. |

| 4. Outsourcing of property management services | After acquiring estimates from multiple bidders, the work shall be outsourced at rational terms taking into consideration the volume and substance of the service. |

| 5. Brokerage of property purchases, sales and leasing | A rational amount of compensation shall be paid taking into account the difficulty of the service, the price of the purchase, sale or lease agreement, and other factors. The amount of the compensation shall fall within the range stipulated in the Building Lots and Buildings Transaction Business Act. (In the case of beneficial interests in trust, compensation shall be based on the lot or building that is subject to the interest.) |

| 6. Placing orders for construction work | After acquiring estimates from multiple bidders, the order shall be placed at rational contract terms taking into consideration the difficulty, the timeframe and other factors of the construction work. |

| 7. Investments in stakes and the like in silent partnerships | Investments in stakes and the like in silent partnerships shall be made at rational and reasonable terms. |

| 8. Other transactions | Terms of the transactions must be fair and reasonable. |

4. Flow Decision-making for Transactions with Interested Parties

(1) In the event that MLP causes JLF to enter into a transaction falling under the above “3. Transactions Subject to the Rules” with an interested party, MLP must confirm that the terms of the transaction fall within the scope set forth above in 3., and that the transaction shall be subject to deliberation by the Compliance Committee and the approval of the MLP’s Board of Directors except in cases where the transaction is a minor transaction as set forth below in (2) a. and b. Each department shall submit the prescribed documents to the MLP’s Board of Directors when entering into a transaction with an interested party in accordance with the type of transaction.

(2) Minor transactions that do not require deliberation by the Compliance Committee and the approval of the MLP’s Board of Directors are set forth below in a. and b.

a. Transactions concerning the acquisition or transfer of securities, the lending and borrowing of securities, the acquisition or transfer of real estate, or the lending and borrowing of real estate

Transactions set forth in Article 245-2 of the Ordinance for the Enforcement of the Act on Investment Trusts and Investment Corporations with a contracted amount of less than 50 million yen per transaction

b. Transactions other than those set forth above in a.

Transactions with a contracted amount of less than 50 million yen per transaction

(3) In the event that JLF enters into a transaction with an interested party and the transaction falls under the transactions set forth below, the approval of the JLF’s Board of Directors and the consent of JLF based on said approval shall be obtained prior to the execution of the transaction with an interested party after obtaining the approval of the MLP’s Board of Directors based on the above (1) and (2).

a. Acquisition or transfer of securities

b. Lending and borrowing of securities

c. Acquisition or transfer of real estate

d. Lending and borrowing of real estate

(4) Notwithstanding the above (3), the following transactions do not require the approval of the JLF’s Board of Directors and the consent of JLF based on said approval

Transactions prescribed in Article 245-2 of the Ordinance for the Enforcement of the Act on Investment Trusts and Investment Corporations

Corporate Conduct

Shutting Out Relationships with Antisocial Forces

MLP has organized a regime of rules and regulations (Basic Policy on Antisocial Forces, Officer and Employee Code of Conduct, Legal Compliance Management Rules, and Guidelines for Handling the Advance Confirmation of Transaction Counterparties) and implements training for all officers and employees to instill a thorough awareness for shutting out any relationships with antisocial forces.

Bribery and Anti-Corruption Policy

MLP has formulated a code of conduct for officers and employees, which stipulates compliance by officers and employees with laws and regulations, prohibition of harassment, prohibition of acts that may cause conflicts of interest, prohibition of insider trading, prohibition of bribery, reporting when violations are discovered, etc. In addition, a specific guide for achieving compliance with laws and regulations, the " The Company has also established a Compliance Manual, a specific guide to ensure compliance with laws and regulations and strives to prevent misconduct.

Regarding specific procedures to be taken upon discovery of violations, etc., compliance management rules have been established, and various reporting contacts have been set up, including the sponsor's external reporting contact, such as the compliance officer and president, etc., which are reported to the internal control committee of the asset management company, the board of directors, and the board of directors of the investment corporation as necessary.

Training for officers and employees regarding compliance with laws and regulations, etc., is conducted on a regular basis to ensure that they are thoroughly informed about the prevention of fraud. Furthermore, MLP strives to prevent problems from occurring during annual internal audits.

Whistleblowers protection

All officers and employees (including seconded employees and contract employees, and those within one year after retirement) , as well as officers and employees of our contractors who have engaged in our commissioned work, that learn of an action that may violate laws, regulations, internal regulations, the code of conduct, or other corporate ethics, are to report to the Compliance Officer, Head of the internal audit organization, a department general manager, the CEO, or a corporate auditor, the General Manager of the Human Resources Department of Mitsui & Co. Asset Management Holdings Inc., and a third-party contact point (an attorney, for example) set up by Mitsui & Co., Ltd. Anonymous reports are also accepted. Through these measures, MLP aims to prevent or quickly discover and correct problems.

In compliance with the Whistleblower Protection Act, the Internal Whistleblowing System Rules stipulate protecting whistleblowers through the preservation of confidentiality about whistleblower reports, protection of personal information and prohibition of termination of employment status or unfair treatment. There are limitations placed on communications involving information such as the person's name.

Access to the report’s contents is limited to persons involved in handling the matter, and the whistleblower shall not be treated unfairly as a result of lodging the report.

Extent of grievance reporting or escalation procedures

MLP properly manages complaints according to its regulations (Regulations for Handling Matters Requiring Management, and others). MLP immediately confirms the facts and investigates the cause of the incident, as well as promptly resolving the situation and preventing its recurrence. MLP is also a member of The Investment Trusts Association, Japan, which outsources mediation to the non-profit Securities and Financial Instruments Mediation Assistance Center.

Follow the link below for inquiries. (Japanese only)

https://www.m-lp.net/inquiry/index.html

Compliance-Related Achievements

| FY2024 | |

|---|---|

| Number of compliance training sessions conducted | 6 times |

Initiatives related to governance at the asset manager company

Asset Management Fees

An asset management fee structure has been introduced that ties fees to distributions per unit and seeks alignment with unitholder interests.

| Fee type | Fee structure | Asset manager incentives |

|---|---|---|

| Asset Management Fee 1 | Linked to NOI |

|

| Asset Management Fee 2 | Linked to net income and DPU |

|

| Acquisition Fee | Linked to acquisition price of newly acquired asset |

|

| Redevelopment Fee | Linked to the construction cost in the event a portfolio asset is redeveloped |

|

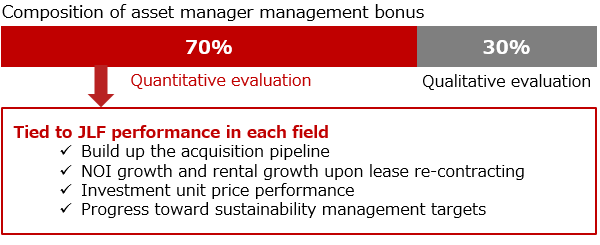

Officer and Employee Personnel Evaluations Remuneration structure designed for Same Boat with investors

Information disclosure

Information disclosure and reporting

1. Engagement with investors

Basic policy

The REIT holds as its basic policy to appropriately conduct prompt, accurate and fair information disclosure based on a constant perspective of the investor and requires the asset manager to conduct appropriate information disclosure based on that policy.

In the event information related to the asset manager, the portfolio assets or the like such that would be stipulated as timely disclosure items at the Tokyo Stock Exchange, the asset manager shall promptly communicate that information to the REIT and prepare and provide the necessary materials to conduct timely disclosure. Furthermore, at the asset manager, responsibilities related to information disclosure reside in Finance&IR Dept.. When the departments indicated in the above organizational chart learn of any important information related to asset management, accounting, compliance or the like that requires disclosure, those departments shall immediately report that information to Finance&IR Dept.. Doing so allows for the concentration and unified management of information at Finance&IR Dept., where responsibility for information disclosure lies. Finance&IR Dept. shall study the need (or lack thereof) for timely disclosure and the timing, submit the information to legal checks as necessary, and, in the event more detailed study is necessary, study the matter upon holding a disclosure committee, and for that information for which disclosure is deemed necessary, conduct disclosure pending approval from the President and CEO.

Through these structures at the asset manager involving information disclosure, the REIT achieves a structure that secures prompt, accurate and fair information disclosure.

2. Specific IR activities

(i)IR for analysts and institutional investors

- Each fiscal period, MLP holds an earnings presentation from the President, CEO and Representative Director of the asset manager.

- Following the earnings presentation, MLP holds one-on-one meetings with institutional investors inside and outside of Japan.

(ii)IR for individual investors

- MLP actively participates in various IR events and presentations for individual investors held by securities firms.

- MLP conducts earnings presentations for investors and meetings to report on operations following the General Unitholders’ Meeting.

(iii)Post IR materials on the REIT’s website

- MLP posts IR materials such as securities filings, earnings briefs and press releases on the JLF’s website.

- The JLF’s website: https://8967.jp/en/

(iv)Establishment of a disclosure committee

- Principles and basic policies are established, and internal structures are prepared in relation to legally required disclosures and timely disclosures.

- Highly urgent and important IR matters are studied, and countermeasures are planned.

3. Scope and term and timing of renewal of Sustainability reports

Scope of the report: Japan Logistics Fund, Inc. and Mitsui & Co., Logistics Partners Ltd (the asset manager)

Term: One year every year, from April through March of the following year

Timing of renewal: In principle, July or August each year

Guidelines of reference: JLF refers to the GRI standards of the Global Reporting Initiative (GRI) for policies and reporting of activities related to ESG.

Contact point for ESG:

Please direct ESG-related inquiries to:

| Asset manager | Mitsui & Co., Logistics Partners, Ltd. |

|---|---|

| E-Mail address | jlf_ir@m-lp.net |