Green Finance

Green finance refers to bonds (green bonds) and borrowings (green loans) to raise funds specifically for initiatives in the environmental field. In principle, it is procured in accordance with the "Green Bond Principles" set forth by the International Capital Market Association, etc.

Through the procurement of funds through the Green Finances, JLF aims to stimulate demand from new investors who are interested in ESG investments, and to strengthen its fund procurement base by expanding its investor base. In addition, JLF will further promote ESG initiatives by understanding the expected level of ESG through dialogue with institutional investors interested in ESG and reflecting the content of such dialogue in its asset management.

Overview of a green finance framework

To conduct green financing (hereinafter referred as the "Green Finance") including the issuance of the Green Bonds, JLF has formulated a green finance framework (hereinafter referred as the "Green Finance Framework") in accordance with the Green Bond Principles 2021 (*1), the Green Bond Guidelines 2022 (*2), the Green Loan Principles 2023 (*3) and the Green Loan Guidelines 2022 (*4).

JLF has developed a green finance framework that conforms to the four requirements set forth by the Green Bond Principles ((1) use of procured funds, (2) project selection criteria and process, (3) fund management methods, and (4) reporting).

JLF has obtained a Green 1(F) (highest for JCR Green Finance Evaluation (*5)) rating in preliminary evaluation for the competence of its Green Finance Framework from Japan Credit Rating Agency, Ltd. (JCR). Please refer to JCR’s website: https://www.jcr.co.jp/en/greenfinance/

| (*1) | "Green Bond Principles 2021" are the guidelines for green bond issuance formulated by the Green Bond Principles Executive Committee, a non-government organization whose secretariat is the International Capital Market Association (ICMA), and are hereafter referred to as “Green Bond Principles.” |

| (*2) | "Green Bond Guidelines 2022" refers to the guidelines formulated and published in March 2017 and revised in March 2020 and July 2022 by the Ministry of the Environment of Japan (hereafter “Green Bond Guidelines”). The Green Bond Guidelines, in accordance with the Green Bond Principles, seek to provide market participants with illustrative examples of specific approaches and interpretations tailored to the Japanese market to aid with decision-making regarding green bonds, thereby spurring green bond issuance and investment in Japan. |

| (*3) | "Green Loan Principles" are the guidelines for loans formulated by Loan Market Association (LMA) and Asia Pacific Loan Market Association (APLMA) that limit the uses of proceeds to projects with environmental objectives, and are hereafter referred to as the "Green Loan Principles 2023". |

| (*4) | "Green Loan Guidelines 2022" refer to the guidelines formulated and published in March 2020 and revised in July 2022 by the Ministry of the Environment of Japan. The Guidelines, in accordance with the Green Loan Principles for green loans, seek to provide borrowers, lenders and other market participants with illustrative examples of specific approaches and interpretations tailored to the Japanese market to aid with decision-making regarding green loans, thereby spurring utilization of green loans in Japan. |

| (*5) | "JCR Green Finance Framework Evaluation" is a third-party evaluation on the policy for the issuance of green bonds or the borrowing of green loans (green finance policy) of an issuer or a borrower based on the Green Bond Principles formulated by the ICMA, the Green Loan Principles formulated by the LMA and the APLMA and the Green Bond Guidelines and the Green Loan Guidelines formulated by the Ministry of the Environment. In this evaluation, JCR conducts "Greenness Evaluation" to assess whether the projects stated in the green finance policy of the issuer or the borrower fall under green projects, and assess allocated to green projects, as well as "Management, Operation and Transparency Evaluation" to assess the management and operation system and transparency of the issuer or the borrower. Then, as the overall evaluation results of these assessments, the "JCR Green Finance Framework Evaluation" is determined. By the way, in order to distinguish the "JCR Green Finance Framework Assessment" from the assessment of individual bonds or borrowings, an "F" is added to the end of the assessment symbol. |

use of procured funds

(1) Use of proceeds of the Green Finance

Net proceeds from the Green Finance will be used for the acquisition of green buildings that meet the following Green Eligible Asset, the implementation of renovation work, etc., or the repayment and redemption of loans (including green loans) or investment corporation bonds (including green bonds) required for these projects.

(2) Eligible criteria

The eligible criteria for Green Eligible Assets and renovation work that are eligible for green finance investment are as follows.

[Green Eligible Assets eligibility criteria]

Eligible criteria for Green Eligible Assets are those that meet the following conditions (i) or (ii).

- Green Buildings

- 3 to 5 stars in DBJ Green Building certification

- B+ to S ranks in CASBEE Building (new construction)

- B+ to S rank in CASBEE Real Estate

- 3 stars to 5 stars in BELS certification (FY2016 standard) (*1)

*1: Excluding logistics facilities with BEI = 0.75 or more - The following levels BELS certification (FY2024 standard)

Non-residential: Level 4 to Level 6(*2)

*2: New acquisitions of existing buildings built before 2016 must be Level 3 or above and excluding buildings with outdated legality (factories, etc. (including logistics facilities): BEI = over 0.75) - Silver rank to Platinum rank in LEED certification (v4.0 or later for BD+C)

- Energy-saving performance

Assets that have obtained or will obtain one of the following certifications by the following third-party certification organizations (hereinafter referred as "Green Building Certification") valid as of the payment date of the Green Bond, the date of the Green Loan, or the reporting date under the Framework.

However, if there is any change in the name of the following Green Building Certification, it shall be read as the new name.

Properties with an ERR value of 30% or higher

[Renovation Eligibility Criteria]

Eligible criteria for renovation work refer to renovation work that has been completed or will be completed within the past 36 months from the date of payment of the green bond or the date of the green loan, and that is intended to meet any of the following criteria for the assets owned by JLF.

- ・Improvement in the number of stars or rank by one or more levels in any of Green Building Certification.

- ・Reduction of GHG emissions, energy consumption, or water consumption by 30% or more

- ・Other environmentally beneficial improvements (expected to reduce usage or emissions by 30% or more compared to previous levels)

- ・Installation or acquisition of equipment related to renewable energy

Project selection criteria and process

A representative of the Finance & IR department of MLP selects projects that meet the eligibility criteria, and the final decision is made by the president of MLP.

Fund management methods

- Funds raised through green finance are used to pay for green-eligible assets and are tracked and managed by Finance & IR department in the internal system.

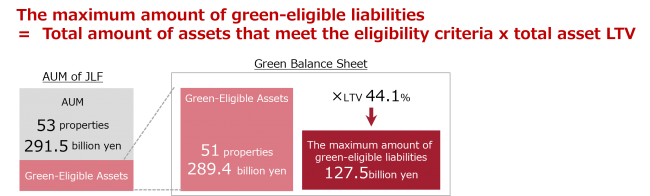

- Confirmation that the total amount of green finance outstanding does not exceed the maximum amount of green-eligible liabilities (total amount of assets that meet the eligibility criteria x total asset LTV) for each fiscal period.

Reporting

If there are unappropriated funds at the time of issuance of the green bond or borrowing of the green loan, JLF will disclose the appropriation plan. In the event that assets subject to the use of funds are sold before the redemption or repayment period, the balance of green finance and the maximum amount of green-eligible liabilities will be disclosed, upon explaining the balance is managed in portfolio level.

In addition, any other major changes in the situation will also be disclosed on JLF's website. The information will be disclosed on an annual basis until the corresponding green finance balance is reduced to zero.

Furthermore, the following items will be disclosed on JLF's website once a year.

2. Fund allocation status

(million yen)

| Amount | Unappropriated amount | |

|---|---|---|

| Green Finance | 20,500 | ー |

| Green Bonds | 2,000 | ー |

| Green Loans | 18,500 | ー |

| The maximum amount of green-eligible liabilities (Total acquisition price of Green Eligible Assets x LTV based on Total Assets) |

127,544 | ー 斜線 |

(Reference)The maximum amount of green-eligible liabilities

As of July 31, 2025. * As for LTV, as of July 31, 2025