An Independent Growth Strategy

Independently creating property acquisition opportunities

JLF has built an abundant track record in sourcing and managing logistics properties. Along the way, it has developed a strong network with logistics real estate market players and the know-how to create flexibility in structuring transactions.

Property sourcing at JLF is not solely reliant on development properties from our sponsor or open auctions in the real estate acquisition market. Instead, JLF leverages its networks and know-how to independently generate acquisition opportunities.

Independent sourcing enables JLF to execute property acquisitions at relatively favorable terms and achieve greater profitability.

Case study

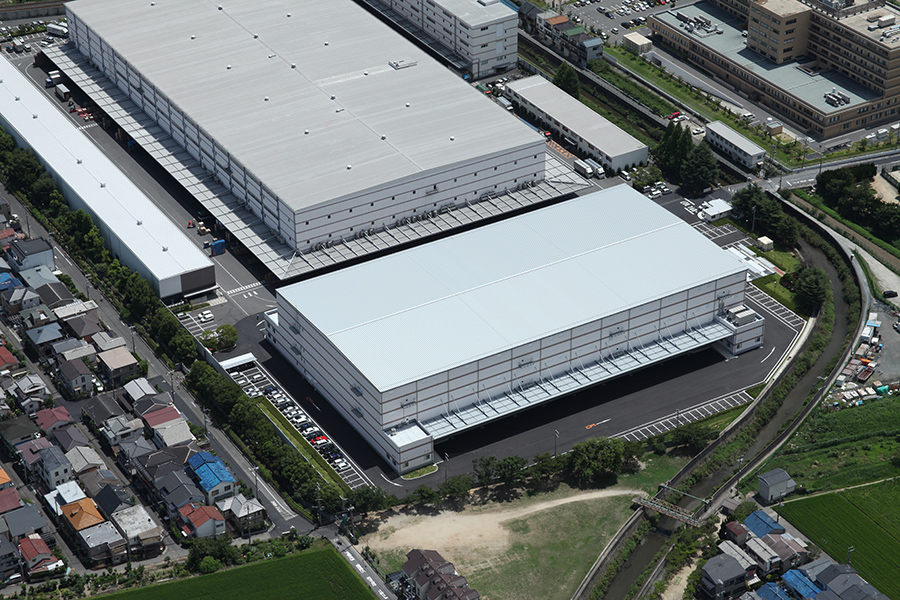

Ichikawa Logistics Center III

Acquisition history

Acquired March 2019. Excellent access to central Tokyo. Off-market transaction enabled acquisition at high yield.

| Acquisition price | 3,850 million yen |

|---|---|

| Expected NOI yield | 6.6% |

Shiroi Logistics Center

Acquisition history

Acquired July 2020. Building specifications make it a highly adaptable property. Leveraged JLF’s OBR know-how to pursue this collaborative development project with a partner.

| Acquisition price | 3,875 million yen |

|---|---|

| Expected NOI yield | 5.4% |

- Expected NOI yield = Expected NOI / acquisition price x 100% (Figures are rounded off to the first decimal place.) Expected NOI is a normalized estimate of medium-term based on annual income and expense projections at the time of the acquisition by the asset manager and is not the forecast for the fiscal period when the property was acquired.

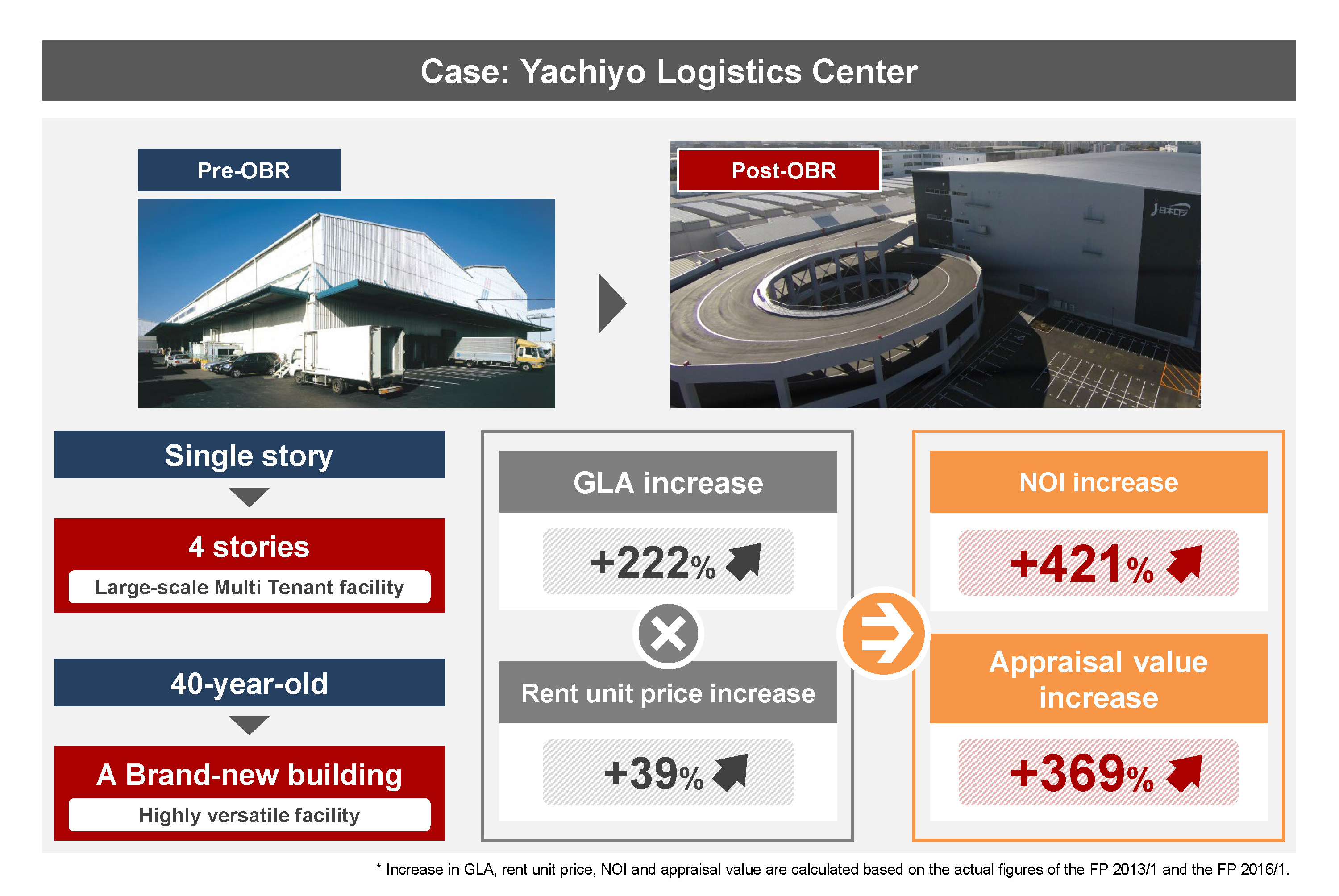

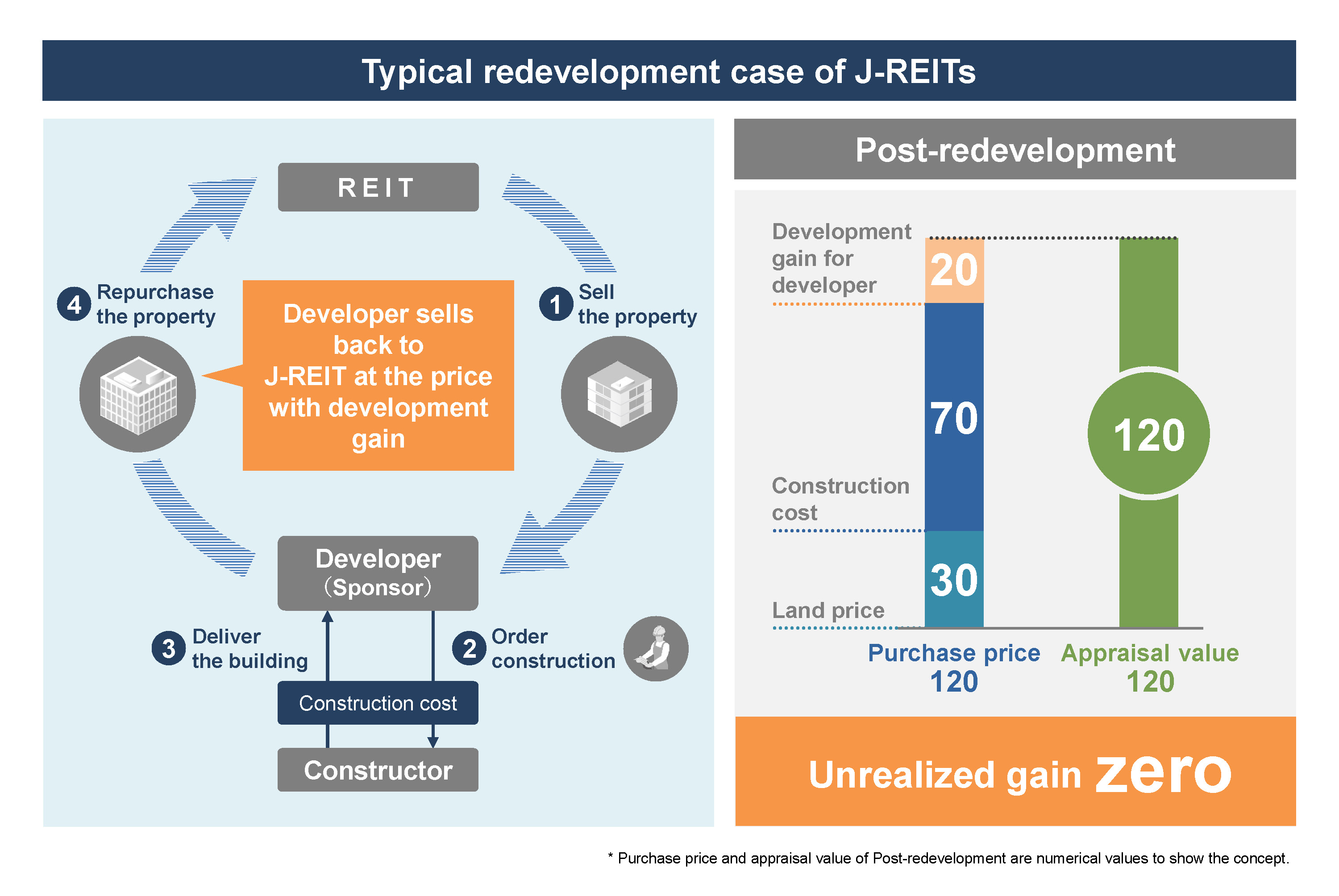

Maximizing asset value through OBR projects

OBR (Own Book Redevelopment) are redevelopment projects of assets owned by JLF.

For example, an OBR project may scrap an old, single-story warehouse and build a 4-story facility with modern specifications in its place. Doing so greatly enhances the property's earning potential and asset value.

This embodies one of JLF's strengths, as JLF is the only J-REIT to execute these redevelopment activities on an ongoing basis.

The benefits of OBR

Recognition unrealized gain through OBR

Track record

Daito Logistics Center

| Appraisal value | +39.0% |

|---|---|

| Operating revenue | +24.9% |

Yachiyo Logistics Center

| Appraisal value | +368.9% |

|---|---|

| Operating revenue | +375.5% |

Kiyosu Logistics Center

| Appraisal value | +526.2% |

|---|---|

| Operating revenue | +843.2% |

Kasugai Logistics Center

| Appraisal value | +344.8% |

|---|---|

| Operating revenue | +454.4% |

- Figures are comparison of the FP pre-OBR and the FP post-OBR.

Strategic property dispositions

The condition of the property and market environment surrounding it change with the passage of time. JLF periodically validates the future cash flow projections of portfolio properties and strives to maintain and enhance portfolio quality through strategic property dispositions.

Because the JLF portfolio enjoys an abundant unrealized gain, property dispositions can lead to capital gains, which in turn can be returned to our unitholders through distributions.

Track record

Funabashi Logistics Center(Sold in October 2018)

| Sale price | 7,900 million yen |

|---|---|

| Capital gain | 926 million yen |

Tajimi Logistics Center(Sold in March 2020)

| Sale price | 13,900 million yen |

|---|---|

| Capital gain | 5,348 million yen |