Distribution in Excess of Earnings

(1) What is Distribution in Excess of Earnings?

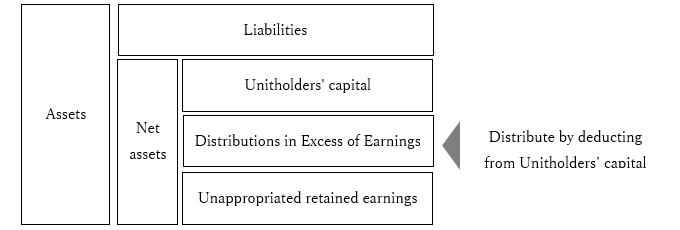

Distribution in excess of earnings refers to the distribution of cash that exceeds accounting profits. This is carried out as a “return of capital,” whereby the Unitholders' capital is reduced and distributed to unitholders.

J-REITs typically distribute more than 90% of distributable profits in order to meet special tax requirements. However, under the Investment Trusts Act, it is permitted to distribute cash in excess of profits—even in cases of loss.

(2) Sources of Distribution in Excess of Earnings

Distribution in Excess of Earnings is made from “Unitholders' capital” or “Capital surplus”, using the cash currently retained by JLF as its source.

Generally, accounting earnings for J-REIT are calculated by deducting various expenses from the total rental income received from tenants, etc. J-REITs typically distribute nearly 100% of their accounting earnings. One of these “various expenses” is depreciation, which is the systematic allocation of the cost of acquired buildings and other assets. Depreciation is a non-cash accounting expense.

Therefore, while depreciation is deducted as an expense from earnings (reducing accounting earnings), the cash equivalent of the depreciation amount is retained by JLF. This retained cash can be used as a source for distributions to unitholders in the form of a “return of capital”.

(3) Implement Policy for Distribution in Excess of Earnings

Compared to other assets, logistics facilities, which are the primary investment targets of JLF, generally have a high ratio of building value to land value and high depreciation expenses, while the ratio of equipment to building value is low and capital expenditures are limited. In light of these characteristics, JLF makes distributions in excess of earnings based on certain rules to ensure efficient cash management and return of earnings to unitholders. In addition, distributions in excess of earnings based on a. through c. below shall not be made if JLF has reserves for reduction entry of special provisions of replaced property, reserves for tax purpose reduction entry or other retained earnings. However, in the event that the entire amount of retained earnings as of the end of the applicable fiscal period is reversed, distributions in excess of earnings based on a. through c. below may be additionally made for the applicable fiscal period.

-

Ongoing distributions in excess of earnings

In principle, JLF shall make distributions in excess of earnings in each fiscal period on an ongoing basis, with the maximum amount of distributions in excess of earnings being an amount equivalent to 60% of depreciation expenses for the applicable fiscal period. In determining the amount of distributions in excess of earnings, the amount of capital expenditure required to maintain and improve the competitiveness of assets under management and the financial condition of JLF (net income for the subject fiscal period, cash flow, one-time gains on sales of properties and cancellation penalties, etc., the total amount of distributions for the subject fiscal period including distributions in excess of earnings, LTV (the ratio of the amount of interest-bearing debt, etc. to total asset/ to the appraisal value of the assets under management), credit rating status, etc. ) shall be given due consideration. In cases where JLF deems it inappropriate based on the economic environment, trends in the real estate market and rental market, etc., the condition of assets under management, and financial conditions, etc., JLF may not make distributions in excess of earnings in whole or in part. -

Temporary distributions in excess of earnings

In addition to ongoing distributions in excess of earnings, JLF may make temporary distributions in excess of earnings when the amount of earnings is less than 90% of distributable earnings, when JLF deems it appropriate due to trends in the economic environment, real estate market, and rental market, or when it is possible to reduce the incidence of income taxes, etc. at JLF. In such cases, JLF may make temporary distributions in excess of earnings. In particular, in the event of dilution of investment units, a large increase in expenses or a large decrease in income due to fundraising such as issuance of new investment units, large-scale repairs, occurrence of a disaster or accident, payment of a settlement due to litigation, implementation of redevelopment of assets under management or tenants move-outs, etc., and the level of distribution per unit is expected to temporarily decrease to a certain degree, JLF will consider the implementation of temporary distributions in excess of earnings for the purpose of equalizing the amount of distributions per unit. -

Distribution in Excess of Earnings Based on Allowance for Temporary Difference Adjustments

In the event of a tax discrepancy (including, but not limited to, impairment losses, asset retirement obligations (including interest expenses), amortization of fixed-term leasehold rights, amortization of goodwill, etc.), JLF will consider the impact of such tax discrepancy on distributions and will make distributions of the allowance for temporary differences (including, but not limited to, recognition of future deductible temporary differences and utilization of tax losses) for the purpose of avoiding the occurrence of taxable income. -

Maximum amount of distribution in excess of earnings

The maximum amount of distribution in excess of earnings, including both ongoing distribution in excess of earnings as described in a. above and temporary distribution in excess of earnings as described in b. above, shall be an amount equivalent to 60% of depreciation expenses recorded for the subject fiscal period (however, the maximum amount shall be the amount stipulated in the rules of The Investment Trusts Association, Japan).

(4) Policy on cash distributions in excess of earnings and matters to be considered when making such distributions

Cash distributions in excess of earnings shall be made in accordance with (3) above only when the conditions set forth in the following items are met, after giving due consideration to the amount of cash distributions in excess of earnings, medium- to long-term capital needs, including the amount of capital expenditures necessary to maintain and improve the competitiveness of the assets under management, which are assumed based on the long-term repair plan, etc., and the financial condition, etc.

- Even after the cash distribution in excess of earnings is made, JLF is expected to secure the investment funds necessary to maintain the asset value of the assets held.

- Even after the cash distribution in excess of earnings is made, it can be judged that the LTV at the end of the fiscal period for which the cash distribution in excess of earnings is made has a reasonable margin against the level of covenants on borrowings agreed upon between JLF and its lenders.

- It is expected that JLF will have sufficient liquidity in cash on hand even after the distribution in excess of earnings, taking into account the expected expenditure of funds in the foreseeable future.

(End)